36+ maximum deduction mortgage interest

Ad Get All The Info You Need To Choose a Mortgage Loan. Web The mortgage interest deduction limit has decreased since the new Tax Cut Jobs Act was passed in 2018.

Mortgage Interest Deduction A Guide Rocket Mortgage

Ad Refinance Your House Today.

. Get a Great Return. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice. Fed Rate Hikes Mean Higher APYs on Bankrate.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Another itemized deduction is the SALT deduction which. Homeowners who bought houses before. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice.

Refinance Your FHA Loan Today With Quicken Loans. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Well Talk You Through Your Options. Single or married filing separately 12550. Web For 2021 tax returns the government has raised the standard deduction to.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Married filing jointly or qualifying widow. Web IRS Publication 936. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Calculate Your Monthly Payment Now. Web Mortgage Interest Tax Deductions FAQ Updated for 2021 For homeowners and investors the mortgage interest tax deduction can be a big help. Fed Rate Hikes Mean Higher APYs on Bankrate.

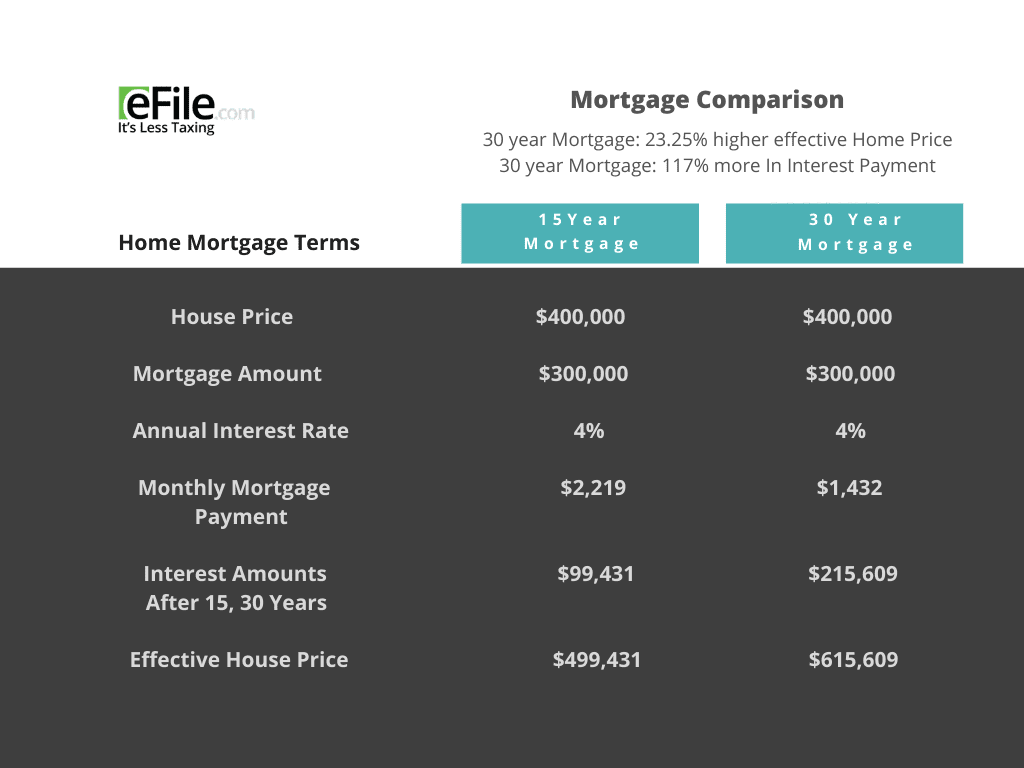

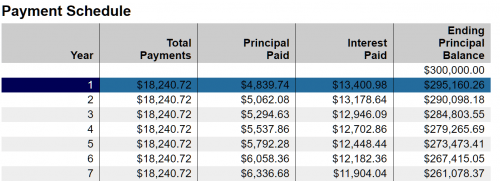

If you took out your home loan before. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

Get a Great Return. For taxpayers who use. 30 x 12 360.

Divide the cost of the points paid by the full term of the loan in. Choose The Loan That Suits You. In the past you could deduct mortgage interested.

Web For 2022 the standard deduction is 25900 for married couples and 12950 for single filers. If your itemizable deductions are above your standard tax. Great News for Savers.

That means that the mortgage interest you. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Great News for Savers.

Home Mortgage Loan Interest Payments Points Deduction

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Or Standard Deduction Houselogic

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1881 Session I Friendly Societies Fourth Report By The

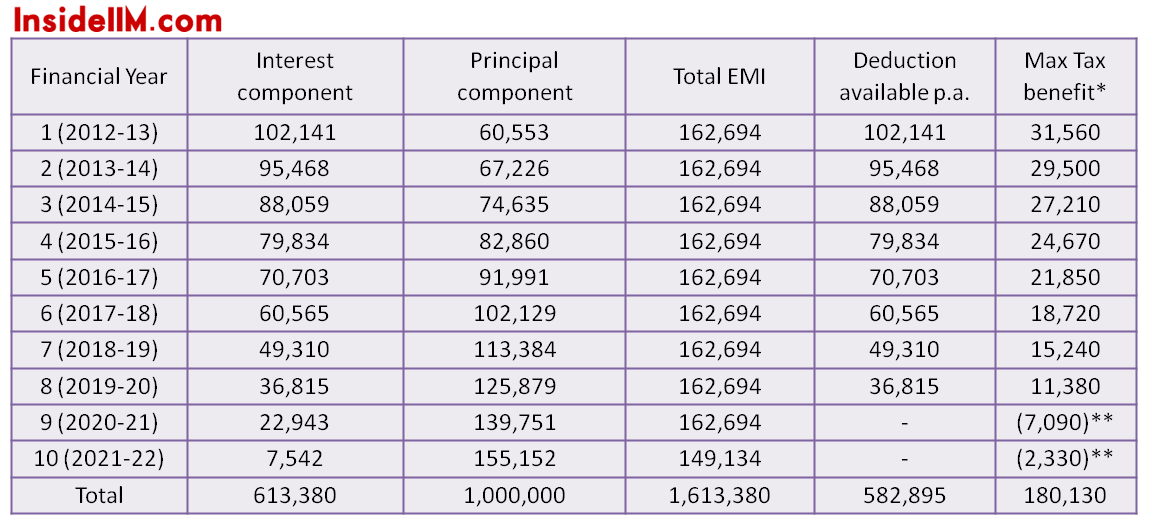

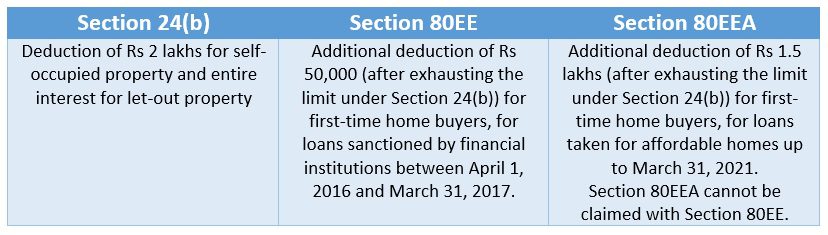

All You Need To Know About Tax Benefits On Education Loan Interest Payments Insideiim

Home Loan Vs Personal Funds How To Choose When Buying A Home

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Who Gets It Wsj

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

Mortgage Interest Deduction Rules Limits For 2023

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country